Recognizing the winds of modernization sweeping across India, Mr. Panicker leveraged his extensive background in marketing electronic products to create a groundbreaking solution for the banking sector: BANCAL. This chip-based banking automation product was a game-changer, achieving over one lakh installations in leading banks across India, including SBI, BOB, UBI, Federal Bank, SBT and Allahabad Bank. Launched at a time when organized computing was still in its infancy in India, BANCAL was hailed as a remarkable achievement and set the stage for future innovations.

Harish has overseen the company’s transition from a single-product software business to a dynamic Software-as-a-Service provider. Key developments include the introduction of flagship applications such as Tulip DeskTM and HKStar Cloud, designed to support the evolving needs of the education and hospitality sectors. These solutions help clients stay competitive in a changing landscape.

His leadership style is based on a collaborative and open approach, fostering a culture of innovation, teamwork, and resilience. This environment has enabled HK Infoware to adapt to challenges and drive sustainable growth.

At HK Infoware Limited (HKIL), our journey has been driven by dedication, adaptability, and continuous progress. Since 1987, we have been leveraging technology to enhance industries and create meaningful impact.

In the bustling city of Kolkata, Mr P.K. Panicker had a dream—to use innovation to transform banking. With this vision, he founded H.K. Industries and, in 1988, introduced BANCAL, a smart chip-based calculator that simplified banking operations. This was just the beginning of an exciting journey.

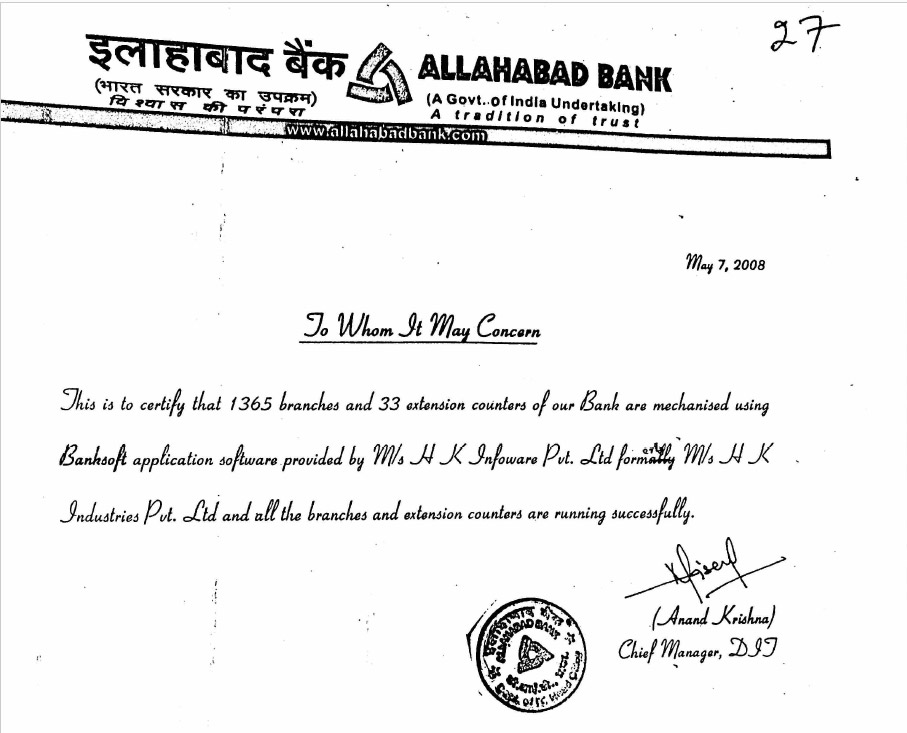

As we grew, so did our ambitions. In 1993, we became a private limited company, and in 1995, we launched Banksoft, a game-changing software that revolutionised branch automation, bringing real-time data processing and improved customer service to the banking sector.

The turn of the millennium marked a new era for HKIL. In 2000, we became a Microsoft Certified Solutions Provider, solidifying our expertise. By 2004, Banksoft had been successfully implemented across Allahabad Bank, spanning the country from Jammu to Kanyakumari. Our solutions were making a nationwide impact.

In 2007, we rebranded as HK Infoware Limited and became a public limited company, opening doors to greater opportunities. The following year, we took on a major e-governance project for the Treasury and Pension Department of Government of Sikkim, showcasing our expertise in digital transformation.

From banking to hospitality and education, HKIL has been at the forefront of innovation, always looking ahead. With a strong foundation and a drive to make a difference, we continue to embrace new challenges and create solutions that shape the future.

Our Vision is to evolve and grow as a prominent Software product and services provider in India with a global footprint! We are committed to earn our customers’ loyalty and patronage through continual improvement of all our work processes driven by Integrity, Innovation and Teamwork.

Our mission is to provide cost-effective, efficient and flexible Software Products and Services of high quality, which deliver long term commercial benefits to our customers based on their key business requirements.

At HKIL, we value our commitment and the trust of our clients and stakeholders. We constantly strive for innovation, excellence, dedication and timely delivery to earn the respect of our clients. At the same time, we do our best to ensure a challenging, yet rewarding and motivating environment for all our team members.

It takes a lot of research and development, planning, technology upgrade and hard work to maintain superior quality of a product or service. At HKIL, we believe in customer satisfaction as the ultimate reward for our efforts,and we achieve that through consistent delivery of high quality products and services in an efficient, cost-effective and timely manner. We pursue continual improvement of all our work processes to meet the expectations of our customers in terms of quality, reliability and service.

HKIL is constantly expanding its eco system by forging alliances with global technology giants and organizations, bringing forth synergy in technology and domain expertise, without losing its focus. After the company’s successful journey for over three decades, the focus area of its future growth is now Education and Hospitality industries.

BANCAL, launched in 1988, was essentially a ‘Banking Calculator’ and also referred to as such. It had a microchip at its heart and was an efficient device to aid and streamline back-office automation for the banking processes.

With the launch of BANCAL, HKIL entered into the development of automation in banking sector of India. This ushered the company into a new era of growth in the Indian Banking sector. The product was the first and only one of its kind and made entry into the banking industry at a time when the concept of organized computing was yet to come.

This enabled the banks to significantly improve their efficiency levels by automating functions like interest calculations, ledger postings, report generation, etc.

BANCAL was truly ahead of its times as no significant automation initiatives were there for the Banking Industry till then. As a result, it was commissioned by almost all the reputed banking establishments in the country. It was a huge success and sold 1,00,000 units till the advent of the new generation personal computers.

Banksoft was the first software solution developed as a product by HK Infoware in 1995 for the banking sector. This product provided integrated online and real time processing of data which helped the banks to significantly improve the speed and quality of their customer services.

This server independent software was highly secure and could be configured with most database servers and operating system platforms of that time, making it very flexible and convenient for operation. Moreover, it provided a total branch automation (TBA) solution to the banks which benefitted them immensely in their back-office processes and in their customer relationship. This opened a new realm of banking experience for the bank staff as well as the customers.

Banksoft had a very successful track record in various Nationalized Banks, Gramin Banks (RRBs), Co-operative Banks and Credit Societies across the country. It entered the Indian market at a time when the banking sector was ushering into a new world of competition, total automation, security of data, fast and efficient customer service and expansion of branch network.

With the technical skill and industry experience of a highly efficient team at one hand and strategic alliances with other solution providers at the other, HKIL has commissioned many turnkey projects in Banking Automation successfully, like:

Banksoft achieved about 4000 installations across the length and breadth of the country, and was able to build up a loyal customer base in banking sector till 2007 when the Core Banking concept came into being.